41 unemployment ri 1099

Form 1099-G is a report of income you received from the Rhode Island ... of another state agency such as child support, court costs, unemployment or. State agencies expected to ramp up audits of unemployment claims. May 05, 2020 · On April 27, 2020, the U. Paying back overpayments. If you can prove your earnings with uploaded documents, such as 1099, W2, or check stubs, s elect the type of earnings document you will upload and then click the .

Here are some free software and tips if you are doing your own taxes this year. **\*\*I AM NOT A/YOUR CPA, THIS POST IS INFORMATIONAL ONLY. IF YOUR SITUATION IS COMPLEX OR THINK SOMETHING IS WRONG, CONSULT A CPA OR ENROLLED AGENT\*\*** First as far as tax software/websites. Unless you want to pay, don't use TurboTax, the software isn't bad by any means, just have questionable upsell tactics for their "free" product and will charge you for just about anything outside a W-2. TurboTax used to hav...

Unemployment ri 1099

Please complete the required fields below or call the Fraud hotline at 1(800)251-2436 or (602)542-9449. (* Denotes Required Fields) To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the "Unemployment Services" button on the My Online Services page. Click the "Get Your NYS 1099-G" button on the Unemployment Insurance Benefits Online page. If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. You will need this information when you file your tax return. The Department of Unemployment Assistance (DUA) will mail you a copy of your 1099-G by Jan. 31 of ...

Unemployment ri 1099. Acting Director of the Rhode Island Department of Labor and Training Matthew Weldon said Pat and other unemployment fraud victims should not be receiving 1099-Gs. Unemployment General Information. Publications, news releases, and articles about unemployment benefits for railroad workers. Downloadable Forms. View, download, and print forms specific to unemployment insurance benefits for railroad workers. myRRB. Secure service options for conducting personal business with us online. ... COVID-19 (Coronavirus) and Unemployment Benefits Last updated: 9/24/2021 at 11:00 a.m.. Español, Hmoob, Somali, Other Languages. Note: If you have worked for a Minnesota employer in the past 18 months, you may be eligible to receive unemployment benefits. Rhode Island's unemployment rate has increased significantly since March 2020 as a result of the COVID-19 pandemic. Together, the federal government and state agencies have extended unemployment compensation to people still waiting to return to work during this unprecedented time.

19 Jan 2011 — The RI Department of Labor and Training announced today that Unemployment Insurance customers may choose to download their 1099 tax forms ... 1099 Income & Unemployment. 5 minute read • Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Some states will mail out the 1099G. Or you might need to go to your state's unemployment website and use the password, etc. that you have been using to certify for weekly benefits to get your 1099G from the state's site. Enter your 1099G in Federal>Wages & Income>Unemployment. Report receiving a 1099-G for benefits you didn't file for. | RI Department of Labor & Training. Section Menu. For Individuals. Unemployment Insurance. Toggle child menu. Temporary Disability / Caregiver Insurance. Career Centers. Job Training Programs. Rhode Island State Jobs.

Rhode Island was caught up in a nationwide wave of unemployment benefit fraud during the pandemic and, with 1099 forms having gone out, some people are just learning they were involved. RI promises more info on unemployment fraud as people frustrated looking for answers ... when her husband received a 1099G from Rhode Island. This is the federal income tax form on which ... Withholding Tax Forms. All forms supplied by the Division of Taxation are in Adobe Acrobat ( PDF) format. To have forms mailed to you, please call (401) 574-8970. Items listed below can be sorted by clicking on the appropriate column heading. Withholding tax forms now contain a 1D barcode. Nov 03, 2021 · Rhode Island is always looking for talented individuals to serve our state. You can find employment opportunities at state agencies, municipalities, or other government entities here . Access supportive services

For general discussion specific to your state, go to [state's live chat](https://www.reddit.com/r/Unemployment/collection/9fed6c28-24a6-412c-a509-3e6cc25775a7) and choose your state. This is for information regarding the Cares Act. Please note, this is for informational and guidance purposes. Included are general qualifications, however, each state makes their own determination on who is eligible. Check your state for the most up-to-date information. Part of the [CARES Act](https://www.congr...

Rhode Island Funding Guide for Freelancers, Self Employed, 1099 Workers, Independent Contractors, & Small Businesses During COVID-19 • 23 June 2021

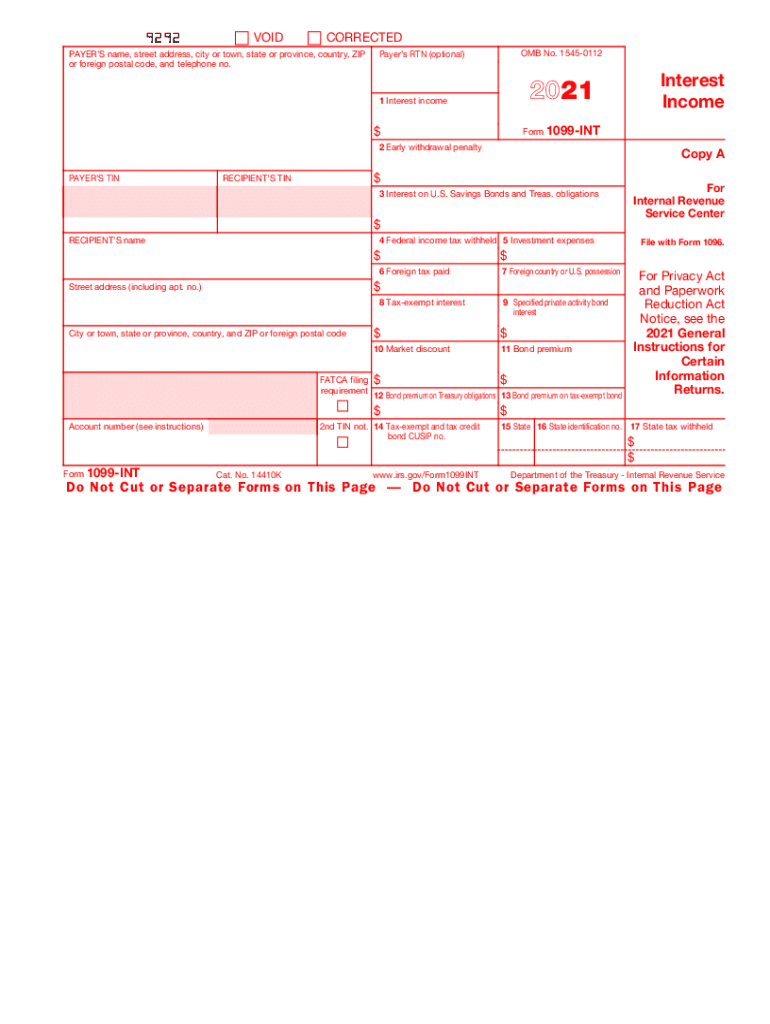

This is what a 1099-G looks like. It is a tax form that provides information on benefits paid in 2020. If you receive Form 1099-G from the Rhode Island Department of Labor and Training for unemployment benefits you did not file for or receive, please report it at the button below.

Thanks in advance for anyone looking at this. My wife works 3 jobs. First, as an audio book narrator. This is self employment, 1099, work. Second, as a per diem employee for PPLM in MA, where she occasionally assists with office work from home. Third, as a simulation patient at a medical school in RI, where she receives a W2, but works an irregular schedule, and only an average of maybe 20 hours/month. The narration work is relatively new, starting around September of 2019, and was pretty regul...

Unemployment Benefits for Self-Employed Workers. Because employers contribute to a fund for unemployment benefits, their employees are eligible to receive benefits from the government if they qualify after losing their job. 1 If you are operating as self-employed, you most likely didn't pay into your state's unemployment fund.

Income and tax information (such as previous tax returns, pay stubs, W-2 forms, 1099 forms, unemployment benefits, etc.) ... Rhode Island Department of Human Services.

1099 G Tax Form Ides . Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training . Unemployment Benefits Are Taxable Look For A 1099 G Form Cbs8 Com . Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago . Form 1099 G Certain Government Payments Definition ...

Thanks to the RIDLT each eventually got the corrected 1099-G form, showing true unemployment compensation as zero, just in time for the IRS filing deadline May 17. So I thought the scam had been ...

Unemployment insurance payments are taxable income. All unemployment claimants who received benefits in 2020 will automatically receive tax form 1099-G from ...

If you do get a 1099 on a fraudulent unemployment claim there is a form to fill ou t on the DLT website and they will send an amended form, according to Jensen.

In R I 43 Percent Of Unemployment Insurance Claims Were Suspected Or Confirmed Fraud The Boston Globe

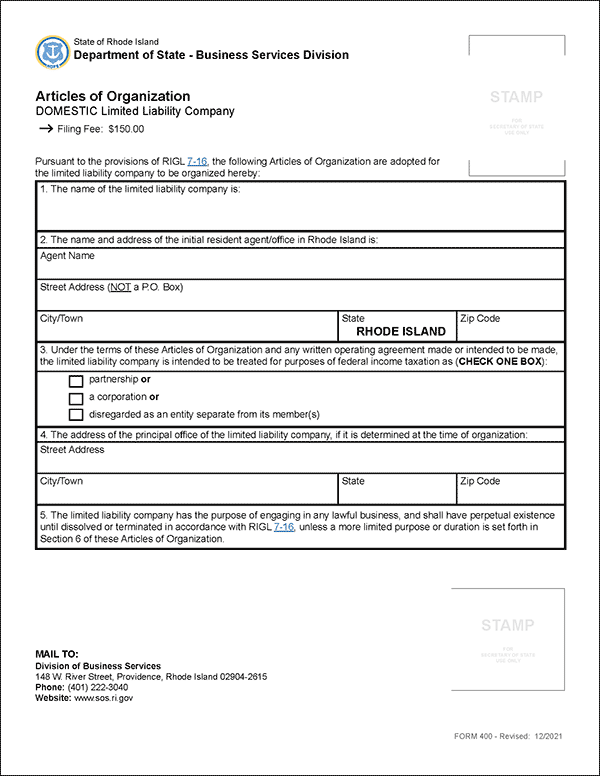

A pass-through entity will be required to provide a Form RI 1099-PT to each member for whom Rhode Island pass-through withholding tax payments, including estimated Rhode Island pass-through withholding tax payments, were made by the pass-through entity during the taxable year. A Sub S Corporation will be required to furnish Form RI 1099-PT, on ...

Of Labor and Training Unemployment Insurance Division PO Box 20340 Cranston RI 02920. These forms can also be accessed online at wwwdltrigovThere is no need to speak with a call center representative to request your 1099. Attention Internet Explorer 10 Users. State of Rhode Island.

25 Oct 2021 — Unemployment Insurance. Unemployment Insurance (UI) is a federal/state insurance program financed by employers through ... Download 1099-G.

* I live in RI, but lived in MA for 20 something years before that. * My taxes were recently filed in MA. I have been in RI for 6 months, changed my address with USPS, and have a lease until Jan 2021. * I have been an online independent contractor for a few years, but my gigs are up and I need to pay bills. Should I file in RI? * I am brand new to this and have been told my whole life that unemployment benefits are for greedy poor people. Well, F that. I have paid tens of thousands in taxes and ...

The IRS statement titled 1099-G is prepared by DETR and reports the amount an individual received in unemployment benefits last year. If you have received a Form 1099-G and you have not collected unemployment benefits in 2020 or believe the amount reported in box number one is incorrect, please complete this form in full.

In Ohio, Bernie Irwin was shocked two weeks ago when she opened the mail and found a 1099-G form saying her husband had claimed $17,292 in unemployment benefits last year. The only problem: Jim ...

The CARES Act and other federal programs that expanded and extended unemployment benefits expired the week ending Sept. 4, 2021. Visit the COVID-19 page to learn more . Receive your unemployment benefits by direct deposit

Springbrook School Springbrook Families If Applicable And Interested Please Consider Attending Facebook

If you have received Unemployment Insurance benefits and would like to download and print a 1099 G form for income tax filing purposes, enter the ...

The Statement for Recipients of Certain Government Payments (1099-G) tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020, as well as any adjustments or tax withholding made to your benefits.

Of Labor and Training Unemployment Insurance Division PO Box 20340 Cranston RI 02920. Are ri unemployment benefits delayed on holidays. These forms can also be accessed online at wwwdltrigovThere is no need to speak with a call center representative to request your 1099. Are unemployment benefits delayed on holidays. New Years Day January 1st.

Amazon Com Ri Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Rhode Island English Prints Office Products

Inside was a 1099-G tax form from the State of Massachusetts. 1099-G forms are commonly used to report certain government payments made to an individual, such as state unemployment compensation. Peggy's reflected $7,300 in income for unemployment benefits in 2020.

If you were considered ineligible for these services while you were collecting unemployment insurance benefits, you may become eligible when your benefits are exhausted. Programs operated by the RI Dept. of Human Services (DHS) RI Works - provides temporary cash assistance for low-income and unemployed parents with children. If you and your ...

Ohio Promises 300 Unemployment Lift But Not Yet Among States Approved By Fema That S Rich Recap Cleveland Com

EDIT: 1099G tax forms for unemployment are in the mail if you want to wait. If you don’t, read below on how to get your tax form online. I’m sharing this in case anyone else was expecting to get some sort of communication from the DLT about your tax forms. You need to go to [the DLT UI customer 1099 form](https://dltweb.dlt.ri.gov/ui1099form/) and fill out your SSN, the 4 digit pin you used for certifying your unemployment, and your birth date. You will get to select which year you want a...

A corrected Form 1099-G showing zero unemployment benefits in cases of identity theft will help taxpayers avoid being hit with an unexpected federal tax bill for unreported income." Last week, the Rhode Island Division of Taxation suggested steps to take if you have been a victim of identity theft.

The IRS says eligible individuals should've received Form 1099-G from their state unemployment agency showing in Box 1 the total unemployment compensation paid in 2020. (If you didn't, you should ...

2021 09 09t02 39 49z Http Jurnal Dpr Go Id Index Php Hukum Oai Oai Jurnal Dpr Go Id Article 1077 2018 09 21t09 04 22z Aspirasi Art Oai Jurnal Dpr Go Id Article 1657 2020 06 09t09 08 13z Ekp Fpg Oai Jurnal Dpr Go Id Article 1643 2020 06 08t06 44 12z

On the next screen, Let us know if any of these uncommon situations apply, select I received non-government unemployment benefits that weren't reported on a 1099-G and Continue. Follow the instructions to enter your unemployment. If you've lost or can't find your 1099-G, select your state below to go to your local unemployment website.

RI 1099-G Form. Form 1099-G, Certain Government Payments is the information return you'll get from governments whether federal, state, or local. If you're living in Rhode Island (RI) and received payment from the state government such as unemployment compensation, you'll get the 1099-G reporting this income.

2021 09 09t02 39 49z Http Jurnal Dpr Go Id Index Php Hukum Oai Oai Jurnal Dpr Go Id Article 1077 2018 09 21t09 04 22z Aspirasi Art Oai Jurnal Dpr Go Id Article 1657 2020 06 09t09 08 13z Ekp Fpg Oai Jurnal Dpr Go Id Article 1643 2020 06 08t06 44 12z

Reemployment Services and Eligibility Assistance (RESEA) If you are collecting unemployment insurance, you may be selected to participate in the Department of Labor and Training's (DLT) Reemployment Services and Eligibility Assistance (RESEA) program. You will be notified of your selection through a letter in the mail.

The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. You will need this information when you file your tax return. The Department of Unemployment Assistance (DUA) will mail you a copy of your 1099-G by Jan. 31 of ...

To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the "Unemployment Services" button on the My Online Services page. Click the "Get Your NYS 1099-G" button on the Unemployment Insurance Benefits Online page. If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124.

Please complete the required fields below or call the Fraud hotline at 1(800)251-2436 or (602)542-9449. (* Denotes Required Fields)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

:max_bytes(150000):strip_icc()/Form1099-G-7fed2e2f71f34ef2ac480afef0d7361c.jpg)

/GettyImages-975814434-e364b497975f4bc389a6ad7264536866.jpg)

0 Response to "41 unemployment ri 1099"

Post a Comment